While a majority of government offices are closed on these days, small business owners and other private employers have the option of staying open. Businesses that close on federal holidays are not required to pay their employees for the day off, and those that stay open are not obligated to pay employees extra for normal work hours. In general, holidays are considered regular workdays and employees receive their normal pay for time worked. If the federal holiday falls on a weekend, it is generally observed on the closest weekday. First, during the 30 calendar days right before the holiday, the employee must be entitled to receive pay for 15 of those days.

This does not mean that the employee must have worked 15 out of 30 days. Second, the employee must have worked on his/her last scheduled shift or day before the holiday and on the first scheduled shift or day after the holiday. The important word to remember is "scheduled." Many people believe this means that if the employee does not work the day after the holiday then the employee does not qualify to receive holiday pay. If the day is one when the employee is not scheduled to work, then he/she may still qualify for the paid holiday.

Hours worked on holidays, Saturdays, and Sundays are treated like hours worked on any other day of the week. California law does not require that an employer provide its employees with paid holidays, that it close its business on any holiday, or that employees be given the day off for any particular holiday. 1.Q.Last week I worked eight hours on the 4th of July holiday, which fell on Wednesday. When I got my paycheck this week I was paid for 40 hours at my straight time rate. Aren't I entitled to extra pay, of at least double time, for working on a holiday? Since you did not work over eight hours on the holiday, or more than 40 hours during the workweek, you were paid correctly.

However, private sector employers do not need to provide holiday pay to employees who work on these federal holidays. This is spelled out by the Department of Labor in the Fair Labor Standards Act , which states that employers do not need to pay employees for time that isn't actually worked. These employers can pay regular wages for work on the holiday if they provide another day off with general holiday pay within the next 30 days. If employers and employees agree, the day off may be taken sometime before the employees' next annual vacation.

Private companies have no obligation to close for federal holidays or to pay their employees overtime or holiday pay when they work on a holiday. Furthermore, employers are not legally required to compensate their employees with paid time off if they decide to close. However, some companies may have policies in place to guarantee workers paid time off. Thirteen percent of employers surveyed closed their offices and provided a week of paid holiday leave between Christmas and New Year's.

Forty-eight percent of employers offered a floating holiday day to employees, typically one or two days a year. These are the most common paid holidays in a private sector organization's paid holiday schedule. They will vary by the company based on the needs of the employees and the needs of the business.

The average United States worker in the private sector gets 8 paid holidays per year according to the U.S. There has also been a push for employers to be more civic-minded, with many pledging to give workers Election Day off. An employer may choose to pay an employee an extra 4% of their gross wages. If the employee works on a stat holiday, they receive this 4% pay plus 1.5 times their regular wage rate for the hours worked.

An employee is entitled to a paid public holiday if they have been employed for at least 90 calendar days during the 12 months before the holiday. They must have worked their regular scheduled day of work before and after the holiday. Employees who work on a statutory holiday receive a payment equal to 1.5 times their regular wages for the first 12 hours, and 2 times the hourly rate after that, plus their average regular pay. If your employees are entitled to overtime, calculating pay can be a bit tricky. The important thing to know is that under federal law, overtime is calculated weekly.

This means if your employee works over 40 hours during the week of typical paid holidays like Thanksgiving, Christmas, or New Year's Day, they are entitled to "time and a half" for the hours worked over 40 hours. Under federal law, a holiday doesn't have a special designation for overtime pay, nor is working on a holiday considered overtime. That said, both federal and state law requires most employers, but not all, to pay overtime to employees whose hours meet the criteria.

This is important if you hold special extended hours during the holiday season, or if you rely on employees to cover additional shifts. However, private sector employers aren't actually legally obligated to provide any paid holidays to employees. In the eyes of the law, those federally-recognized holidays are still viewed as regular work days.

Things are totally different for employers in the private sector. Private employers aren't required by federal law to give employees any of the federal holidays off. However, many of them offer at least some of the federal holidays as paid time off .

The Federal government provides at least ten paid holidays per year, while the national average is still 7.6. Some employers also provide "floating" holidays, which allows you to take a paid holiday for a non-typical day you celebrate. Another commonly paid holiday option is a floating holiday or two in which the employee determines the day to take off as part of his or her paid holiday schedule.

These are offered so that, for example, employees with various religious and cultural celebrations and memorials and employees who wish to extend paid holiday weekends, have more options. All employees who have been employed for at least 30 calendar days before a holiday and who worked their scheduled shift before and after a holiday are entitled to holiday pay. Employees receive statutory holiday pay if they have been employed for 30 calendar days and have worked on 15 of the 30 days prior to the statutory holiday.

An employee who works on a general holiday that fell on a regular day of work receives a general holiday pay (i.e. average wage) plus 1.5 times their wage rate for each hour worked. Statutory paid holiday entitlement is limited to 28 days, so any employees working over 5 days per week are still only entitled to 28 days' paid annual leave by law. Employers can choose to offer more leave than the legal minimum , however, they don't have to apply the rules that apply to the statutory leave to the extra holidays .

Employees are paid statutory holiday pay if they work or take the day off. If an employee works on Christmas Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day. If an employee works on Remembrance Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day.

If an employee works on Thanksgiving Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day. If an employee works on Labour Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day. If an employee works on Canada Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day.

If an employee works on Victoria Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day. If an employee works on Good Friday, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day. If an employee works on Family Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day.

If an employee works on New Year's Day, then the employee is entitled to general holiday pay of an amount that is equal to at least 1.5 times their wage rate for each hour worked on that day. If employers end the employment before a general holiday, employees are still entitled to general holiday pay of 5% of total wages for the four-week period immediately before the holiday. The general holiday pay must be paid with the last wages no later than 10 business days after the employment ended. All non-union staff employees who are eligible for paid holidays receive one floating holiday to be used during the calendar year. Staff hired after January 1 will receive the floating holiday the following calendar year.

The International Foundation of Employee Benefits surveyed Paid Leave in the Workplace in 2017. This survey found that 45% of employers grant their employees Christmas Eve off from work, and 23% New Year's Eve. Additionally, 13% of employers provided their workers with a week of paid holiday between Christmas and New Year's Eve. Furthermore, 48% offered their employees a floating holiday day normally one to two times a year.

Legally, during federal holidays, employers are not obliged to give their employees time off from work. That is unless the employers work for the government or a financial institution. Furthermore, if employers grant their employees the day of, they are not legally obliged to pay them. However, most offer it as a perk of working for the company, so to attract top talent and keep employees happy. To see the remaining paid holidays for 2020, go to the Human Resources web section.

In addition to the paid holidays, staff have other leave options they can use for work-life balance. As much fun as it would be if this was a holiday on a boat, alas it is not. A floating holiday is an extra day that employees can use to observe holidays of their choosing outside of the employer's holiday schedule and the nation's norms. The best part is that floating holidays can help staff who belong to minority religious or cultural groups — and therefore celebrate different holidays — feel less marginalized. Others like to use the opportunity to take days like their birthday or anniversary off or just simply turn a long weekend into an even longer getaway.

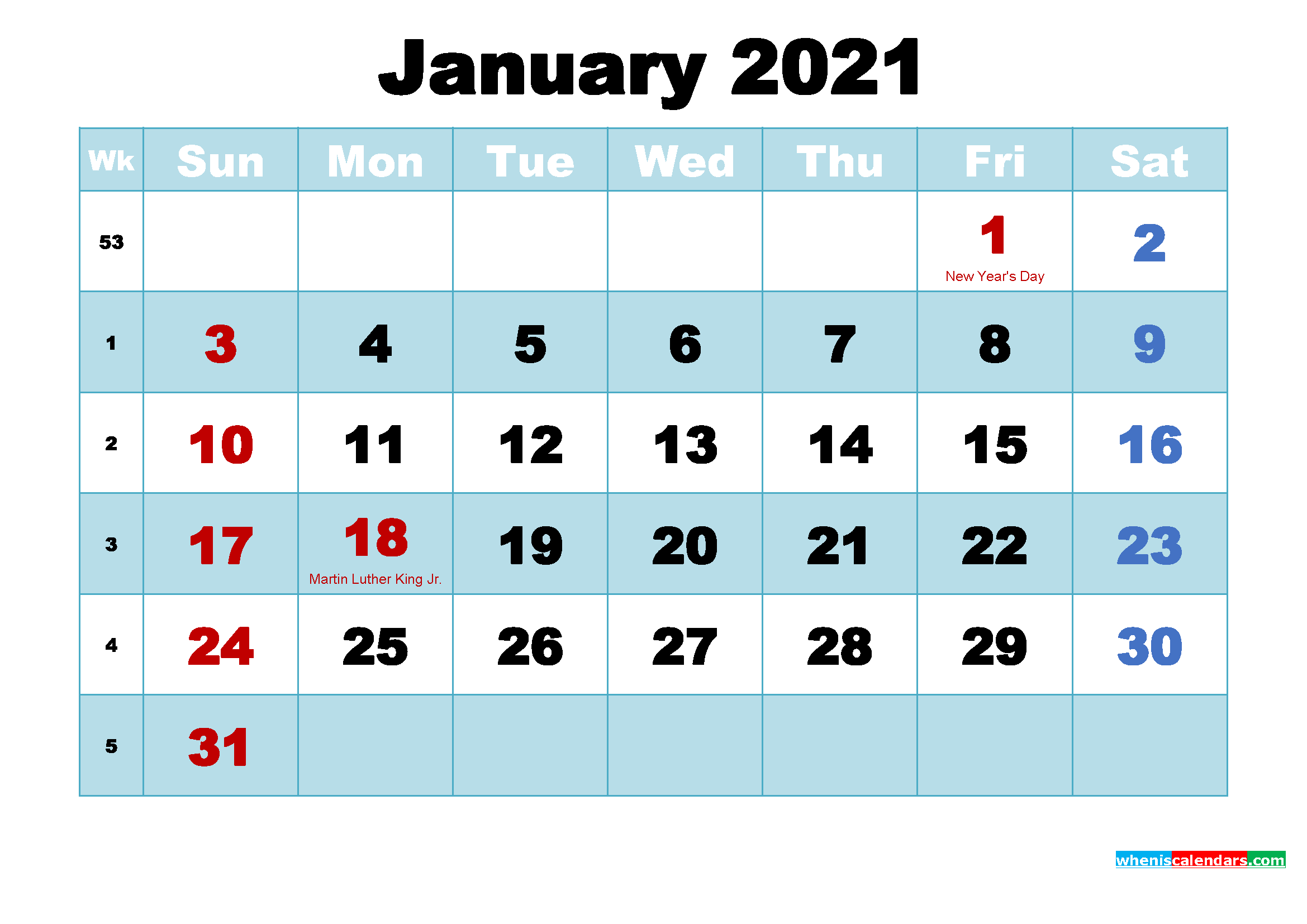

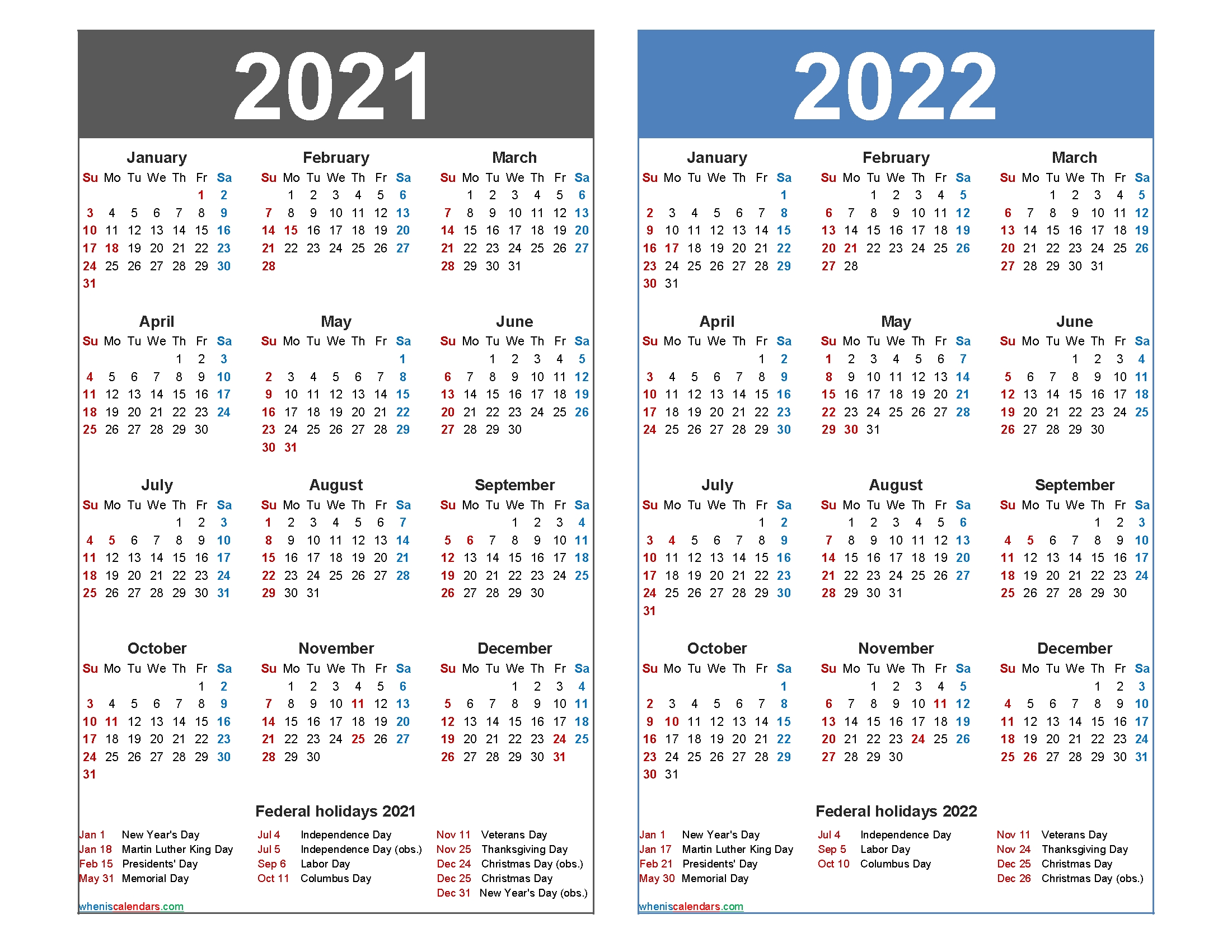

In general, the public holiday pay an employee receives is one-twentieth (1/20) or 5% of their total wages over the 4-week period preceding the week on which the holidays occur. Read on to learn about the statutory holidays observed in Canada in 2021 and 2022, the history behind each designated holiday, stat holiday pay rules, when to expect the August long weekend, and more. Employees receive holiday pay on stat holidays even though they do not work. If an employee is required to work on a stat holiday, they earn a premium rate (1.5-2x) on top of the regular holiday pay.

To put this into perspective, for most employees who work 5 days per week, 5.6 weeks of holiday translates to a minimum of 28 days' paid holiday per year. For those on fixed hours and pay, a week's holiday pay will simply be equivalent to a week's salary. If the holiday falls on a regular day of work and an employee doesn't work on Christmas Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage. If the holiday falls on a regular day of work and an employee doesn't work on Remembrance Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage. If the holiday falls on a regular day of work and an employee doesn't work on Thanksgiving Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage.

If the holiday falls on a regular day of work and an employee doesn't work on Labour Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage. If the holiday falls on a regular day of work and an employee doesn't work on Canada Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage. If the holiday falls on a regular day of work and an employee doesn't work on Victoria Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage.

If the holiday falls on a regular day of work and an employee doesn't work on Good Friday, then they are entitled to general holiday pay of an amount that is at least their average daily wage. If the holiday falls on a regular day of work and an employee doesn't work on Family Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage. If the holiday falls on a regular day of work and an employee doesn't work on New Year's Day, then they are entitled to general holiday pay of an amount that is at least their average daily wage.

If an employer agrees to designate additional general holidays for their employees, all employment standards rules related to general holiday pay still apply for these additional holidays. Employees should confirm this and any pay entitlements with their employer. Employees who work on a general holiday are normally entitled to 1 ½ times their regular rate of pay for the hours worked on the day in addition to their general holiday pay.

An employee who works on Remembrance Day and who is entitled to receive wages for at least 15 of the 30 calendar days immediately before Remembrance Day may be entitled to receive another day off with pay. That day with pay may be taken at the end of the employee's vacation or any other day the employee and employer may agree upon. The University of Kentucky observes the following holidays, except where continuous service is essential, in accordance withUK Human Resources Policies and Procedures #83.0 – Holiday Leave.

In order to qualify for university holiday leave, including Christmas and New Year's Day, an employee must be in a paid status the scheduled days before and the day after the holiday. Please refer to HRP&P #83.0 for detailed information regarding holiday leave. Holidays are usually a time for celebration, reflection, or remembrance, but for small business owners and employees, holiday pay policy can be confusing.

Here's a brief refresher on what's legal for holiday, overtime, and vacation pay. Federal holidays are public holidays created by a country's federal government and established by law (Federal Law – 5 U.S.C. 6103). Employees are paid for these holidays and all non-essential federal offices remain closed. This guide and downloadable 2022 holiday calendar will detail each holiday and the history behind them. Generally, it's up to the employer to determine how they'll handle federal holidays, holiday pay, scheduling and more. While it's not legally required, many employers do offer holiday pay to their employees to reward and incentivize them for working on those days.

Keep in mind that while holiday pay isn't mandatory, standard rules about overtime pay will still apply on those days—since they're viewed as a normal workday. Though the Federal government and most state governments don't enforce paid holidays as a part of the law, most companies still provide them to their employees. The average number of paid holidays Americans receive per year is 7.6, but this can vary based on industry, state, and the number of years in a profession.